|

The US Mega-carrier Delta Air Lines has released details of its June 2020 performance as well and detailing its continued response to the COVID-19 global pandemic. The airline racked up over $7 billion of losses during the month that saw a number of flights reinstated after a long period of grounding because of the lack of demand and travel restrictions.

“A $3.9 billion adjusted pre-tax loss for the June quarter on a more than $11 billion decline in revenue over last year, illustrates the truly staggering impact of the COVID-19 pandemic on our business. In the face of this challenge, our people have acted quickly and decisively to protect our customers and our company, reducing our average daily cash burn by more than 70 percent since late March to $27 million in the month of June,” said Ed Bastian, Delta’s chief executive officer. “Given the combined effects of the pandemic and associated financial impact on the global economy, we continue to believe that it will be more than two years before we see a sustainable recovery. In this difficult environment, the strengths that are core to Delta’s business – our people, our brand, our network and our operational reliability – guide every decision we make, differentiating Delta with our customers and positioning us to succeed when demand returns.”

June Quarter Financial Results

- Adjusted pre-tax loss of $3.9 billion excludes $3.2 billion of items directly related to the impact of COVID-19 and the company’s response, including fleet-related restructuring charges, write-downs related to certain of Delta’s equity investments, and the benefit of the CARES Act grant recognized in the quarter

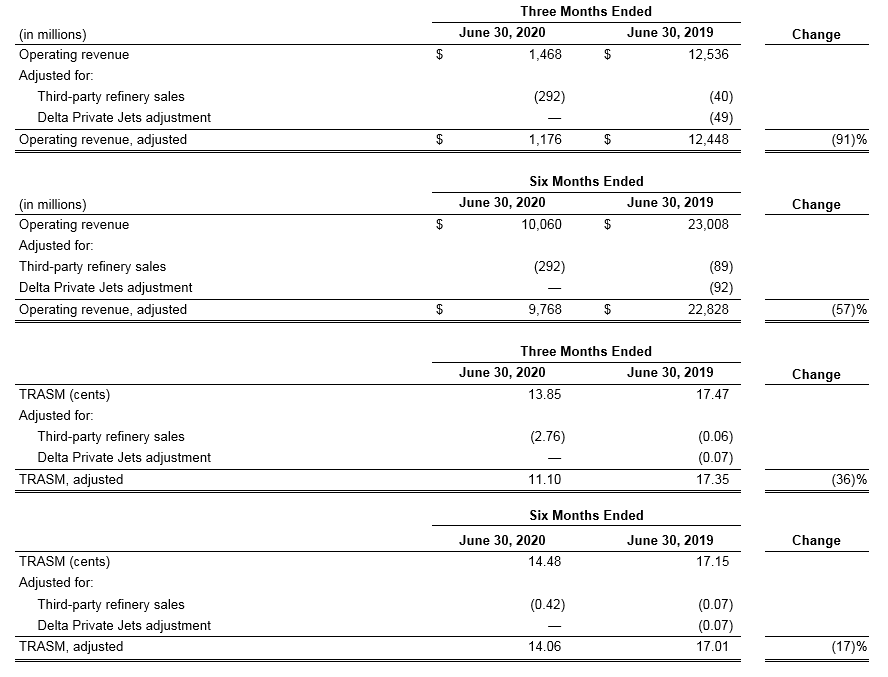

- Total adjusted revenue of $1.2 billion, which excludes refinery sales, declined 91 percent versus prior year on system capacity reduction of 85 percent compared to the prior year

- Total operating expense decreased $4.1 billion over prior year. Total adjusted operating expense decreased $5.5 billion or 53 percent in the June quarter compared to the prior year, driven by lower capacity- and revenue-related expenses and strong cost management throughout the business

- At the end of the June quarter, the company had $15.7 billion in liquidity

Update on COVID-19 Response

In response to the COVID-19 pandemic, the company has prioritized the safety of customers and employees, the preservation of financial liquidity and ensuring it is well positioned for recovery. Actions under these priorities include:

Protecting the health and safety of employees and customers

- Adoption of new cleaning procedures on all flights, including disinfectant electrostatic spraying on aircraft and sanitizing high-touch areas before each flight

- Taking steps to help employees and customers practice social distancing and stay safe, including requiring employees and customers to wear masks, blocking middle seats and capping load factor at 60 percent and modifying boarding and deplaning process

- Installing plexiglass shields at all Delta check-in counters, Delta Sky Clubs and gate counters, adding social distance markers in the check-in lobby, Delta Sky Clubs, at gate areas and in jet bridges

- Launching a Global Cleanliness organization dedicated to evolving Delta’s already high cleanliness standards, seeking to bring the same focus and rigor that has underpinned Delta’s reputation for unmatched operational reliability

- Providing COVID-19 testing for employees in partnership with the Mayo Clinic and Quest Diagnostics

- Giving customers flexibility to plan, re-book and travel including extending expiration on travel credits through September 2022. Delta has provided more than $2.2 billion in cash refunds in 2020

Preserving financial liquidity

- Raising nearly $15 billion in financing transactions since early March, at a blended average interest rate of 5.5 percent, including the unsecured loan portion received under the CARES Act payroll support program (“PSP”)

- Reducing cash burn (see Note A) throughout the June quarter with target to achieve breakeven cash burn by year end

- Amending credit facilities to replace all fixed charge coverage ratio covenants with liquidity-based covenants

- Extending maturities of $1.3 billion of borrowings under revolving credit facilities from 2021 to 2022

- Aggressively managing costs through lower capacity, reduced fuel expense and cost initiatives including reduced work schedules and voluntary employee leaves of absence, parking aircraft, consolidating facilities and eliminating nearly all discretionary spend

- Obtaining $5.4 billion of grant funds and unsecured loans through the PSP of the CARES Act to be paid in installments through July 2020

- Continuing to evaluate future financing opportunities by leveraging unencumbered assets. We are eligible and submitted a non-binding Letter of Intent to the U.S Treasury Department for $4.6 billion under the CARES Act secured loan program. The company has not yet decided whether it will participate and has the ability to elect participation until September 30, 2020

Defining Delta’s recovery path

- Positioning Delta to be a smaller, more efficient airline over the next several years by accelerating fleet simplification with the retirement of entire MD-88, MD-90, 777 and 737-700 fleets and portions of the 767-300ER and A320 fleets in 2020

- Taking advantage of reduced demand to accelerate airport construction projects in Los Angeles, New-York LaGuardia and Salt Lake City, in an effort to shorten timelines and lower the total cost for the projects

- Launching voluntary separation and early retirement programs to proactively manage headcount and rescale operations. Programs provide cash severance, fully paid healthcare coverage, enhanced retiree healthcare for certain participants, and enhanced travel privileges to eligible employees who elect to participate

Revenue and Capacity Environment

Demand for air travel declined significantly in the June quarter as a result of COVID-19, with enplaned passengers down 93 percent year over year. As a result, Delta’s adjusted operating revenue of $1.2 billion for the June quarter was down 91 percent versus the June 2019 quarter. Passenger revenues declined 94 percent on 85 percent lower capacity. Non-ticket revenue declined 65 percent, as Cargo, MRO and Loyalty revenues declined at a lower rate than ticket revenue.

Cost Performance

Total adjusted operating expense for the June quarter decreased $5.5 billion or 53 percent versus the prior year quarter excluding a $1.3 billion CARES Act benefit, and $2.5 billion in restructuring charges from fleet-related decisions and other charges. This performance was driven by a $1.9 billion or 84 percent reduction in fuel expense, a 90 percent reduction in maintenance expense from parking over 700 aircraft and significantly lower volume- and revenue-related expenses. Salaries and benefits expense was down 24 percent, helped by more than 45,000 employees electing to take voluntary unpaid leaves.

“Our June quarter cost performance reflects extraordinary work by the entire Delta team, as we removed more than 50 percent from our adjusted cost base,” said Paul Jacobson, Delta’s chief financial officer. “We expect to achieve a similar 50 percent year-over-year reduction in the September quarter despite a sequential increase in capacity, reflecting the increased variability we have achieved in our cost structure.”

Balance Sheet, Cash and Liquidity

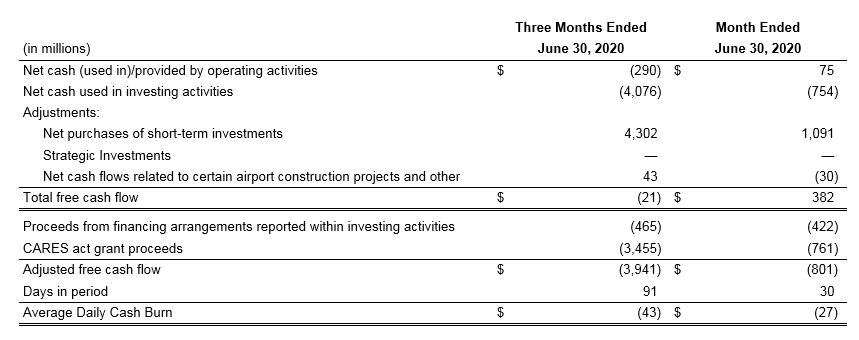

Delta ended the June quarter with $15.7 billion in liquidity. Cash used in operations during the quarter was $290 million. Daily cash burn averaged $43 million for the quarter with an average of $27 million for the month of June, a 70 percent decline from levels in late March.

At the end of the June quarter, the company had total debt and finance lease obligations of $24.6 billion with adjusted net debt of $13.9 billion. During the quarter, the company raised $11 billion in new liquidity at a blended average rate of 6.5 percent. New financing completed during the quarter included $5.0 billion in slots, gates and routes secured financing, $2.8 billion in sale-leaseback transactions, $1.4 billion of the PSP loan, $1.3 billion in unsecured notes, $243 million in B tranches of Enhanced Equipment Trust Certificates (“EETCs”) and an additional $250 million on its 364-day secured term loan.

At the end of the June quarter, the company’s Air Traffic Liability totaled $5.0 billion including a current liability of $4.7 billion and a non-current liability of $0.3 billion. The noncurrent air traffic liability represents our current estimate of tickets to be flown, as well as credits to be used, beyond one year. Travel credits represent approximately 60 percent of the total Air Traffic Liability.

“Our average daily cash burn has improved sequentially each month since March and we remain committed to achieving breakeven cash burn by the end of the year,” Jacobson continued. “We successfully bolstered our liquidity to $15.7 billion at the end of June through new financings and CARES Act funding during the quarter, with adjusted net debt of $13.9 billion increasing by $3.4 billion since the beginning of the year. By raising cash early and aggressively managing costs, we are prepared to navigate what will be a volatile revenue period while making decisions that position Delta well for the eventual recovery.”

CARES Act Accounting, Restructuring Charges and Investment-Related Write Downs

In April 2020, Delta was granted $5.4 billion in emergency relief through the PSP of the CARES Act to be paid in installments through July 2020. In the June quarter, the company received $4.9 billion under the PSP, consisting of $3.5 billion in grant funds and a $1.4 billion low-interest, unsecured 10-year loan. The remaining $544 million will be received in July 2020. In the June quarter approximately $1.3 billion of the grant was recognized as a contra-expense, which is reflected as “CARES Act grant recognition” on the Consolidated Statements of Operations over the periods that the funds are intended to compensate. The remaining $2.2 billion of the grant was recorded as a deferred contra-expense in other accrued liabilities on the Consolidated Balance Sheets. The company expects to use all the proceeds from the PSP by the end of 2020.

During the June quarter, the company made the decision to retire the entire MD-90, 777 and 737-700 fleets and portions of its 767-300ER and A320 fleets by late 2020. This is in addition to the decision in the March quarter to accelerate retirement of its MD-88 fleet from December 2020 to June 2020. The company also cancelled its purchase commitment for four A350 aircraft from LATAM. Primarily as a result of these decisions, the company recorded $2.5 billion in fleet-related and other charges, which are reflected in “Restructuring charges” on the Consolidated Statement of Operations.

During the June quarter the company recorded a write-down of $1.1 billion in its investment in LATAM Airlines and a $770 million write-down in its investment in AeroMexico following their financial losses and separate Chapter 11 bankruptcy filings. Delta also wrote down its investment in Virgin Atlantic during the quarter, resulting in a $200 million charge. Write-downs related to equity partners are reflected as “Impairments and equity method losses” on the Consolidated Statement of Operations.

June Quarter Results

June quarter results have been adjusted primarily for the CARES Act accounting, restructuring charges, and investment-related write downs described above.

Note A: The following tables show reconciliations of non-GAAP financial measures. The reasons Delta uses these measures are described below. Reconciliations may not calculate due to rounding.

Delta sometimes uses information ("non-GAAP financial measures") that is derived from the Consolidated Financial Statements, but that is not presented in accordance with accounting principles generally accepted in the U.S. (“GAAP”). Under the U.S. Securities and Exchange Commission rules, non-GAAP financial measures may be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for or superior to GAAP results. The tables below show reconciliations of non-GAAP financial measures used in this release to the most directly comparable GAAP financial measures.

Forward Looking Projections. The Company is not able to reconcile forward looking non-GAAP financial measures because the adjusting items such as those used in the reconciliations below will not be known until the end of the period and could be significant.

Pre-Tax (Loss)/Income and Net (Loss)/Income, adjusted. In the current period, pre-tax (loss)/income and net (loss)/income, adjusted exclude the following items directly related to the impact of COVID-19 and our response:

- Restructuring charges. We recognized $2.5 billion of restructuring charges following strategic business decisions in response to the COVID-19 pandemic. These charges are primarily related to impairments from the decisions to retire the 777, MD-90 and 737-700 fleets and certain of our 767-300ER and A320 aircraft.

- CARES Act grant recognition. We recognized $1.3 billion of the grant proceeds from the CARES Act payroll support program as a contra-expense. We are recognizing the grant proceeds as contra-expense based on the periods that the funds are intended to compensate and we expect to use all proceeds from the payroll support program by the end of 2020.

- Impairments and equity method losses. We recognized $2.1 billion of charges related to write-downs of our investments in LATAM and Grupo Aeroméxico following their financial losses and separate Chapter 11 bankruptcy filings, and the write-down of our investment in Virgin Atlantic based on our share of its historical and projected losses.

We also adjust pre-tax (loss)/income and net (loss)/income for the following items to determine pre-tax (loss)/income and net (loss)/income, adjusted for the reasons described belo

- MTM adjustments and settlements on hedges. Mark-to-market ("MTM") adjustments are defined as fair value changes recorded in periods other than the settlement period. Such fair value changes are not necessarily indicative of the actual settlement value of the underlying hedge in the contract settlement period. Settlements represent cash received or paid on hedge contracts settled during the applicable period.

- Equity investment MTM adjustments. We recorded our proportionate share of loss from our equity investments in Virgin Atlantic, Grupo Aeroméxico and LATAM in non-operating expense. (As a result of Grupo Aeroméxico's and LATAM’s bankruptcy filings, we no longer have significant influence over Grupo Aeroméxico or LATAM and have discontinued accounting for these investments under the equity method in the June 2020 quarter.) We adjust for our equity method investees' hedge portfolio MTM adjustments to allow investors to understand and analyze our core operational performance in the periods shown.

- MTM adjustments on investments. Unrealized gains/losses on our equity investments in GOL, China Eastern, Air France-KLM and Hanjin-KAL, the largest shareholder of Korean Air, which are accounted for at fair value in non-operating expense, are driven by changes in stock prices and foreign currency. Adjusting for these gains/losses allows investors to better understand and analyze our core operational performance in the periods shown.

- Delta Private Jets adjustment. Because we combined Delta Private Jets with Wheels Up in January 2020, we have excluded the impact of Delta Private Jets from 2019 results for comparability

Operating Revenue, adjusted and Total Revenue Per Available Seat Mile ("TRASM"), adjusted. We adjust operating revenue and TRASM for third party refinery sales for the reasons described below. We adjust for the Delta Private Jets sale for the same reason described above under the heading pre-tax (loss)/income and net (loss)/income, adjusted.

- Third-party refinery sales. We adjust operating revenue and TRASM for refinery sales to third parties to determine operating revenue, adjusted and TRASM, adjusted because these revenues are not related to our airline segment. Operating revenue, adjusted and TRASM, adjusted therefore provides a more meaningful comparison of revenue from our airline operations to the rest of the airline industry.

Cash Burn. We present cash burn because management believes this metric is helpful to investors to evaluate the company's ability to maintain current liquidity and return to cash generation. The company defines cash burn as net cash from operating activities and net cash used in investing activities, adjusted for (i) net redemptions of short-term investments, (ii) strategic investments, (iii) net cash flows related to certain airport construction projects, (iv) proceeds from financing arrangements that are reported within investing activities, (v) CARES Act grant proceeds, and (vi) other charges that are not representative of our core operations, such as charges associated with our voluntary separation and early retirement programs. Adjustments include:

- Net purchases of short-term investments. Net purchases of short-term investments represent the net purchase and sale activity of investments and marketable securities in the period, including gains and losses. We adjust for this activity to provide investors a better understanding of the company's free cash flow generated by our operations.

- Strategic investments. Cash flows related to our investment in Hanjin-KAL, the largest shareholder of Korean Air, are included in our GAAP investing activities. We adjust free cash flow for this activity because it provides a more meaningful comparison to the airline industry.

- Net cash flows related to certain airport construction projects and other. Cash flows related to certain airport construction projects are included in our GAAP operating activities and capital expenditures. We have adjusted for these items, which were primarily funded by cash restricted for airport construction, to provide investors a better understanding of the company's free cash flow and capital expenditures that are core to our operational performance in the periods shown.

- Proceeds from financing arrangements that are reported within investing activities Cash flows from proceeds from financing arrangements that are reported within investing activities (such as certain sale-leaseback transactions) are removed from free cash flow in calculating daily cash burn to better illustrate the cash generated from our core operations.

- CARES act grant proceeds. Cash flows related to the CARES Act Payroll Support Program grant proceeds, reported within operating activities in GAAP results. We adjust free cash flow for this item in calculating daily cash burn to better illustrate the cash from our core operations.

Operating Expense, adjusted. In the current period, operating expense, adjusted excludes the following items directly related to the impact of COVID-19 and our response: restructuring charges and CARES Act grant recognition, as discussed above under the heading pre-tax (loss)/income and net (loss)/income, adjusted. We also adjust operating expense for MTM adjustments and settlements, third-party refinery sales and Delta Private Jets sale adjustment for the same reasons described above under the headings pre-tax (loss)/income and net (loss)/income, adjusted and operating revenue, adjusted and TRASM, adjusted to determine operating expense, adjusted.

Fuel expense, adjusted and Average fuel price per gallon, adjusted. The tables below show the components of fuel expense, including the impact of hedging and the refinery on fuel expense and average price per gallon. We then adjust for MTM adjustments and settlements on hedges and the Delta Private Jets sale for the same reasons described under the heading pre-tax (loss)/income and net (loss)/ income, adjusted.

Adjusted Net Debt. Delta uses adjusted total debt, including aircraft rent, in addition to adjusted debt and finance leases, to present estimated financial obligations. Delta reduces adjusted total debt by cash, cash equivalents and short-term investments, and LGA restricted cash, resulting in adjusted net debt, to present the amount of assets needed to satisfy the debt. Management believes this metric is helpful to investors in assessing the company's overall debt profile.

Non-Fuel Unit Cost or Cost per Available Seat Mile, ("CASM-Ex"). In the current period, CASM-Ex excludes the following items directly related to the impact of COVID-19 and our response: restructuring charges and CARES Act grant recognition, as discussed above under the heading pre-tax (loss)/income and net (loss)/income, adjusted. We also adjust CASM for the following items to determine CASM-Ex for the reasons described below. We adjust for refinery sales to third parties for the same reason described under the heading operating revenue, adjusted and TRASM, adjusted. We adjust for the Delta Private Jets sale for the same reason described above under the heading pre-tax (loss)/income and net (loss)/income, adjusted.

- Aircraft fuel and related taxes. The volatility in fuel prices impacts the comparability of year-over-year financial performance. The adjustment for aircraft fuel and related taxes allows investors to understand and analyze our non-fuel costs and year-over-year financial performance.

- Profit sharing. We adjust for profit sharing because this adjustment allows investors to better understand and analyze our recurring cost performance and provides a more meaningful comparison of our core operating costs to the airline industry.

|

Editor in Chief.

Jason's many years within the media and aviation industries have seen him working for airlines, tour operators, travel agents, radio stations, magazines and media consultancy operations. He loves to travel, often more for the journey than arriving at the destination. Strolling along a beach at dusk, red wine, reading and cheesecake are some of his favourite things.

Editor in Chief.

Jason's many years within the media and aviation industries have seen him working for airlines, tour operators, travel agents, radio stations, magazines and media consultancy operations. He loves to travel, often more for the journey than arriving at the destination. Strolling along a beach at dusk, red wine, reading and cheesecake are some of his favourite things.